Since 2003 generating business and moving the securitization market

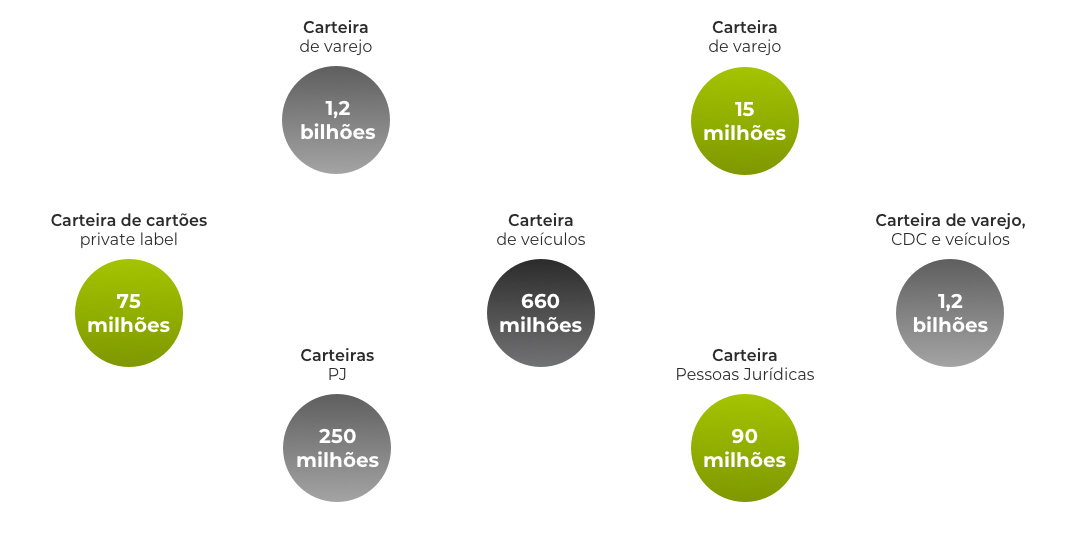

TWIN has been operating in the financial credit securitization market since 2003. It has already coordinated several acquisitions of defaulted credits, including the first major sale of past-due assets of Santander in Brazil in 2005, totaling R$ 1.2 billion, acquired by Merryl Linch. It has its own portfolios and provides investor management.